Childcare Vouchers and Government Tax Free Childcare

We accept most payment methods including childcare vouchers and we support various other schemes for parent funding.

BOOK NOW

Move More accept childcare vouchers and Government tax free childcare!

What does this mean?

You could save you 20% (or more!) on your childcare costs!*

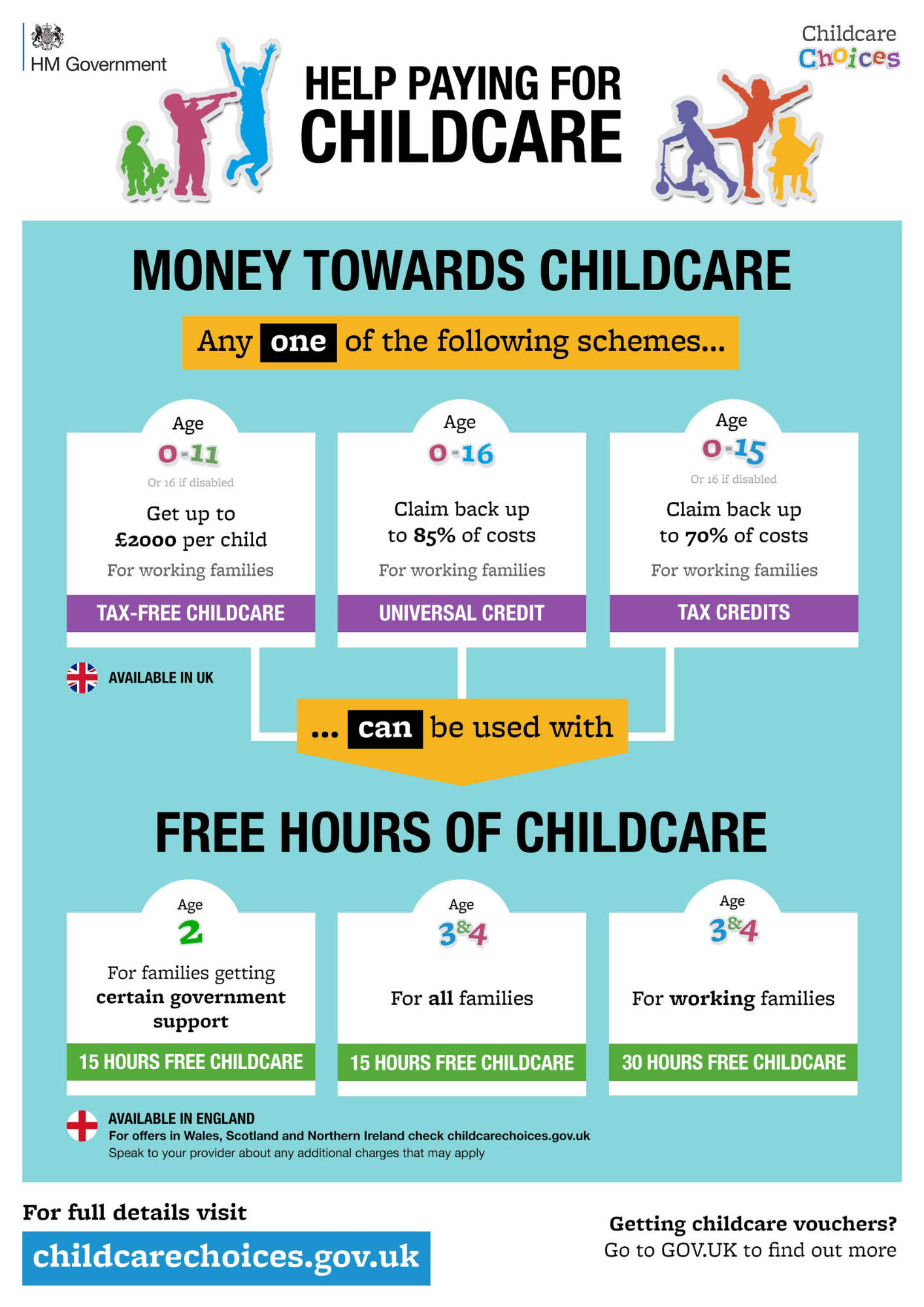

If you already get childcare vouchers, you’ll be able to continue to get them for as long as your employer runs the scheme, or as long as you stay with your employer (a list of accepted childcare voucher providers can be found here). If you change jobs or your employer stops running the scheme you can apply for the tax-free childcare scheme instead.

From April 2018, the previous voucher schemes that were managed by your employer closed to new applicants and was replaced by Government Tax-Free Childcare, which you can apply for online.

The government will pay £2 for every £8 you pay your childcare provider, via an online ‘Childcare Account’.

Eligible families will get 20% of their annual childcare costs (up to £2,000) paid for by the government;up to £500 every 3 months (£2,000/year) for each of your children to help with the costs of childcare (depending on if the provider accepts childcare costs). This goes up to £1,000 every 3 months if a child is disabled (up to £4,000 a year until they’re 17).

NB: You cannot receive childcare vouchers and sign up to the tax-free childcare scheme at the same time.